(3) Businesses that attain early and sustained profitability have a better shot at achieving long-term growth. percentage of the profits in order to repay the higher level of initial investment. Q: I had one question that I was hoping you could help clear up for me. Determine your Allocation Percentages: Your Current Allocation Percentages: are based on what you are currently spending in each of these foundational areas (Profit, Owners Comp, Tax, and Operating Expenses). A special allocation is a financial arrangement that is set up in a. Recently, I was asked a very insightful question regarding Profit First and income allocation. (2) A small, profitable business can be worth much more than a large business surviving on its top line. Learn the 3-step process for implementing the Profit First system here. Using Michalowicz's Profit First system, viewers will learn that (1) Following four simple principles can simplify accounting and make it easier to manage a profitable business by looking at bank account balances. This isn’t just a semantic change of variables, it also affects how you look at your. The Profit First formula gives the profit portion the highest priority: Sales Profit Expenses.

Just as the most effective weight loss strategy is to limit portions by using smaller plates, Michalowicz shows that by taking profit first and apportioning only what remains for expenses, entrepreneurs will transform their businesses from cash-eating monsters to profitable cash cows. While it makes sense to set aside money for expenses first, it doesn’t guarantee that there will always be profit, only that the expenses will be paid.

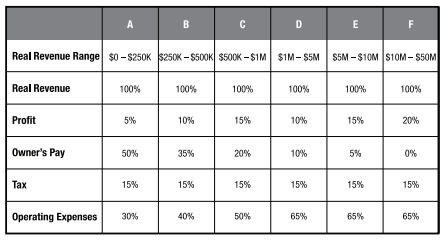

PROFIT FIRST ALLOCATION PERCENTAGES SERIAL

Serial entrepreneur Mike Michalowicz has developed a behavioral approach to accounting to flip the formula: Sales - Profit = Expenses. The problem is, businesses are run by humans, and humans aren't always logical. Conventional accounting uses the logical (albeit, flawed) formula: sales - expenses = profit. Target Allocated Percentages: Ideal Allocation of Cash: Current Allocation: 13. Shawn Van Dyke has taken the core concepts of the Profit First methodology, created by Mike Michalowicz, and customized them to address the specific needs of. on the percentage of their income that is subject to Colorado income tax. invested cash first, and then switch to an even ownership percentage allocation. 10th and the 25th are good dates because it achieves a semi-monthly rhythm of. Part-year residents and nonresidents must first calculate Colorado tax as. By default, LLC profits are split according to ownership percentage. In Profit First, author Mike Michalowicz offers a simple, counterintuitive cash management solution that will help small businesses break out of the doom spiral and achieve instant profitability. designed to be flexible however, the 10/25 rule is a best practice.

0 kommentar(er)

0 kommentar(er)